Fixed Deposit Schemes

Why Banks Fail You ?

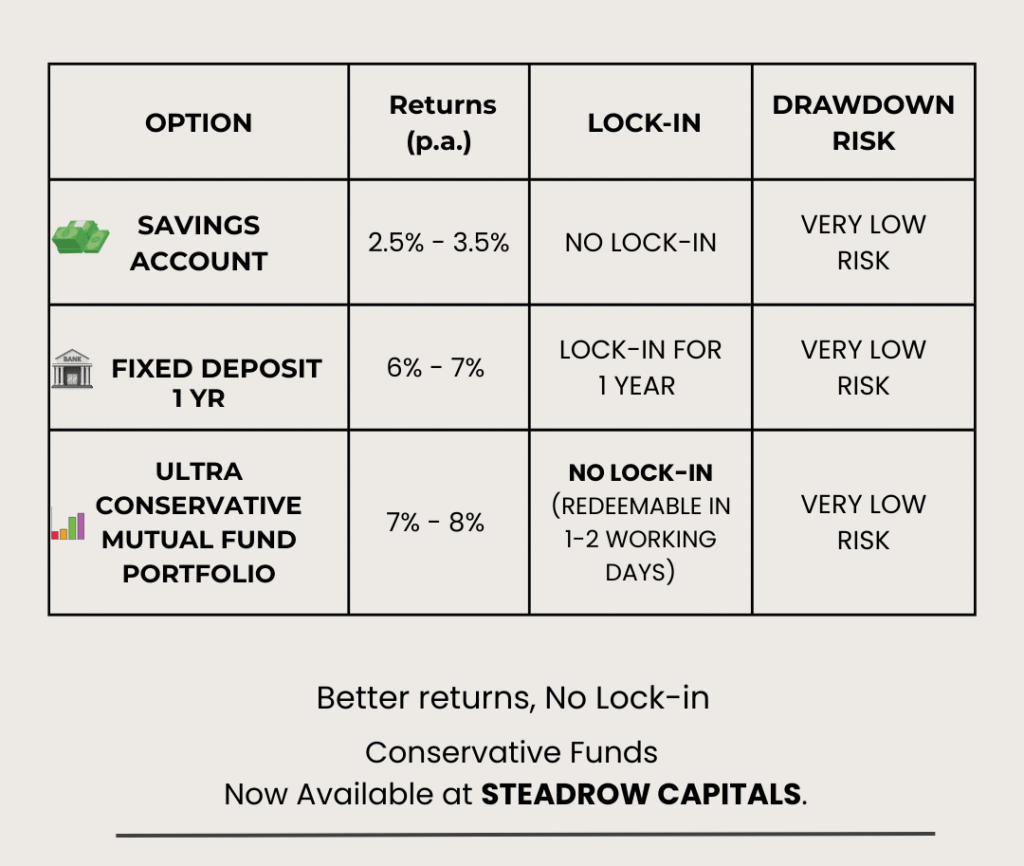

A Smarter Alternative to Fixed Deposits

Looking to park some extra cash safely?

Think traditional Fixed Deposits (FDs) are your only safe option?

At Steadrow Capitals, we offer a FD alternative that’s not only safer for your future but smarter for your money because parking your cash shouldn’t mean putting it to sleep.

Conservative portfolio at Steadrow Capitals:

- Similar safety as FD

- Better-than-FD returns

- No penalties, no lock-ins

- 2-day redemption

- Backed by expert fund selection at Steadrow

A Quick Illustration

Imagine ₹10,00,000 in your bank account for quick access.

Now you can’t put this money in FD because you want easy access. So, for 1 year:

- In a bank savings account @ ~2.5%: You earn ₹25,000 (before tax)

- In Steadrow’s conservative fund @ ~7.2%: You earn ₹72,000

→ Plus, you can EXIT ANYTIME with NO PENALTY / NO LOCK-IN and reinvest when needed.

Use Cases: Where Our FD Alternative Shines

1. Investing money for short term

Got ₹10 lakhs lying idle for that Diwali car purchase this year?

You can’t put this money in FD because you will need it in less than a year for car purchase.

And savings account gives you just ~2%.

With Steadrow’s conservative funds, you can park your money and earn better-than-FD returns while you wait for that car purchase. And you can redeem anytime in just 2 days, no penalties, no lock-ins.

Better than FD returns + no lock-in.

Smart waiting pays better.

2. Emergency Buffer, But Smarter

Your emergency fund needs to be liquid and easily accessible, but that doesn’t mean it should be earning next to nothing.

This is your emergency fund upgrade:

Safe + earns more + available in 48 hours.

3. Idle Cash After Investments

Already invested long-term? Great.

But don’t let your remaining cash just sit in a ~2% savings account.

Use our low-risk fund and earn more while still keeping it accessible without any lock-in

4. Waiting for the Next Big Move

Got an eye on a market opportunity but don’t want your money idle while you wait?

Our conservative fund is the perfect holding ground better than FD, instantly movable when the time is right.

FDs are fine if you love the 90s.

But for everyone else who wants their cash to be safe, flexible, and productive, Steadrow’s fixed-income strategy is FD 2.0.

Make your idle cash feel a little more alive?